Return on Investments - Multifamily

In the world of real-estate syndicating, there are multiple metrics tossed around to help determine the return on potential investments. The ones I want to focus on today are the ones we use:

- Average Cash-on-Cash (CoC) Return

- Total Return on Investment

- Average Internal Rate of Return (IRR)

I will briefly mention why we use them, the pros and cons, and what to watch out for.

We will start off with the Average Cash-on-Cash return.

This is calculated by taking the cash distribution divided by the cash in the deal and averaging that out over each year of the deal.

Example: You invest $100K, receive an $8K distribution year 1, $9K year 2, and $10K year 3. Your returns over the years would be 8%, 9%, and 10% respectively and the average Cash on Cash comes in at 9%. Pretty straightforward especially for deals that do not have any refinance or return of capital events. Now, if a deal does have a return of capital events then this can get a bit tricky and a bit mis-leading.

Example: Same scenario as before except at the end of year 3, beginning of year 4 there was a refinance event that returned 75% of your capital back to you. The return for year 4 was $6K and for year 5 was $8K. Because of the refinance event, you only have $25K left in the deal yielding a cash-on-cash return of 24% year 4 and 32% year 5, creating an overall average cash-on-cash return of 16.6%. That’s a pretty great return but it definitely feels skewed a bit. Any error in the projections (good or bad) could drastically increase or decrease the CoC return after the refinance which doesn’t make this the best metric to use necessarily all the time (i.e. a $2K miss is only a 2% cash-on-cash decrease before the refinance but an 8% decrease after).

So what is ideal and what do you want to see?

Ideally you want to see a fairly strong cash-on-cash early in the deal as this lowers the overall risk of the investment because unless projections are way off, that cash-on-cash should be more stable. Note: A low average cash-on-cash return with a high total return on investment and internal rate of return generally means most of the returns will come from the exit of the investment. That means there is more risk in the investment as who knows what is going to happen between now and five, seven, even ten years down the road. A good rule of thumb is you want a good amount of the total return to be from cash on cash as that means the investment has lower overall risk.

The next metric to discuss is the Total Return on Investment.

This metric is simply telling you how much money you receive back during the life of the investment. I.e. if you invested $50K and received $100K back your total return on investment would be 100%. By itself, this metric isn’t very useful as it doesn’t give good insight on the risk of the investment nor what strategy is being used. Combined with the IRR and CoC it allows you to determine if either of those are misleadingly due to a high return of capital event. In a “straight” deal with no refinance event this will tell you the total return to expect after the set hold time but it does not account for time in the deal. In other words, this metric may tell you your money will double but at a glance it won’t tell you if that will happen in 3 years or 10 years.

So what is ideal and what do you want to see?

Ideally you want to see a fairly strong cash-on-cash early in the deal as this lowers the overall risk of the investment because unless projections are way off, that cash-on-cash should be more stable. Note: A low average cash-on-cash return with a high total return on investment and internal rate of return generally means most of the returns will come from the exit of the investment. That means there is more risk in the investment as who knows what is going to happen between now and five, seven, even ten years down the road. A good rule of thumb is you want a good amount of the total return to be from cash on cash as that means the investment has lower overall risk.

The next metric to discuss is the Total Return on Investment.

This metric is simply telling you how much money you receive back during the life of the investment. I.e. if you invested $50K and received $100K back your total return on investment would be 100%. By itself, this metric isn’t very useful as it doesn’t give good insight on the risk of the investment nor what strategy is being used. Combined with the IRR and CoC it allows you to determine if either of those are misleadingly due to a high return of capital event. In a “straight” deal with no refinance event this will tell you the total return to expect after the set hold time but it does not account for time in the deal. In other words, this metric may tell you your money will double but at a glance it won’t tell you if that will happen in 3 years or 10 years.

The final metric to discuss and is my personal favorite, the Average Internal Rate of Return.

The average internal rate of return is shown as the interest yield as a percentage expected from an investment and helps us capture distributions throughout the years as well as the time value of money. This is good because a distribution in year 1 is worth more than a distribution in year 5 of the same amount (due to the time value of money). If we factor that into the equation it helps us make good comparisons for various opportunities. See the examples below:

In these examples you can see that all investments have the same Total Return on Investment as well as Average Cash on Cash Return, however, they each have a different Average IRR. You can clearly see the benefit to IRR from receiving cash earlier on in a deal vs later. The sooner you get the money back the sooner you can put it back to work for you.

If you would like to learn more about Multifamily Real Estate and how to invest, please email me directly at James@jcoreinvestments.com

Inflation in Multifamily

For those of you who follows financial or political news, you may have seen a lot of recent chatter about inflation. Most people view high inflation as a bad thing. Just look how the cost of a cup of coffee has increased over the years. It causes the cost of goods to go up making everyday life more expensive. But how does it affect investments in apartment complexes?

I personally see inflation as a good thing in our investment space. The reason for this is the time value of money. As you may know, money today is worth more than money tomorrow. This is primarily because of inflation. If we have 5% inflation in the cost of goods a year from now, you would require $1.05 a year from now to be equal to $1 today. In addition, because we generally go with a fixed interest rate, rising inflation only serves to benefit us. Imagine a scenario where we are paying interest only on a loan of 3% and there is a 5% year-over-year inflation rate. We essentially just profited on our loan because we came out ahead on loan rate vs interest rate. This works because if I borrow a $1 from you today and owe you $1.03 a year from now, however due to inflation that money is worth $1.05 now, we just made $0.02.

Now, realistically that won’t happen because the Fed has indicated if inflation were to begin to take off, they would work hard to reel it back in, but, the higher inflation goes the narrower the gap becomes it and our interest rates which benefits us and our leveraged capital

If you would like to learn more about Multifamily Real Estate and how to invest, please email me directly at James@jcoreinvestments.com

What's better the Stock Market or Real Estate?

Foreign Service Officers are well positions for retirement with the 3-Legged Stool – “FERS + Social Security + TSP.” The question is do you want to wait till retirement to start earning passive income. There are so many options out there to invest so what’s better the Stock Market or Real Estate?

What if I told you there is a way you can take total responsibility for your financial outcomes NOW, and can keep those fees that Wall Street & the IRS would of taken year after year from stock market investing. This Blog will provide an alternative that you may have never considered that provides immediate cash flow, higher returns with less headaches. Also very easy to manage especially while serving overseas. And NO the Stock Market isn’t going to get you there.

But what about your other investments in the stock market? Are you concerned about the future of the stock market? If so, you’re not alone. How can you possible plan for your financial future with the uncertainty and volatility of the stock market. After exploring the Pros and Cons in investing in the stock market, I’ll suggest an alternative for you to consider and NO its not Single Family Homes (SFH) either.

I know many Foreign Service Officers are purchasing SFH rentals using their disposable income while stationed overseas or turning their primary house into a rental properties to earn passive income. This is a great introduction into real estate but have you ever considered Multifamily Real Estate Investment?

Before getting in Multifamily, let’s review my I no longer invest in the Stock Market nor Single Family homes.

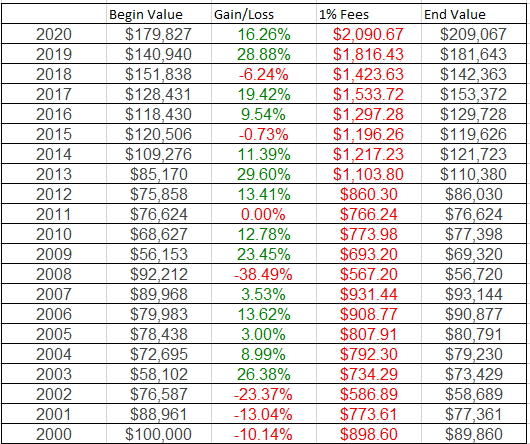

Stock Market returns will surprise you. The average stock market return over the last 20 years from the S&P 500 was 6.41% (from 2000 to 2020) and 9.65% over the last 30 years (from 1990 to 2020) [1] That means that if you invested $100,000 in 2000 it would be worth $346,456 in the end of 2020 – not bad right? But wait…not so fast.

Market volatility can crush your returns. What most investors don’t realize is that the same $100,000 isn’t actually worth $346,456 twenty years later – that’s because of the volatility of the stock market from year to year. In fact, that same $100,000 was actually worth $255,891 – which is only 4.81% return compounded every year. Not nearly as good but still not bad … until we realize these returns are BEFORE brokerage fees.

Fees stealing you blind?

The average expense ratio for actively managed mutual funds is between 0.5% and 1.0% and can go as high as 2.5% or even more. For passive index funds (ETFs), the typical ratio is approximately 0.2%[2]. Most investors have a blended portfolio of ETFs and mutual funds, so let’s assume the average fee is 1.0% per year.

After taking out a 1% fee each year, instead of being worth $346,456, your $100K invested twenty years ago is now only worth $209,066 – a mere 3.77% compounded return!

What makes it even worse is you still have to pay fees even if you lost money that year.

Let’s not forget taxes!

If you’re filing jointly and making more than $77,201, your long term capital gains rate is 15%. If you sold your entire portfolio, the taxes you’d have to pay would push your average annual return from 3.77% to 3.34%. Reducing the worth to $192,707. ($100K Initial investment + $92,707 Net Gain after 15% taxes)

Inflation – The Silent Killer

The dollar had an average inflation rate of 1.99% per year between 2000 and today, producing a cumulative price increase of 51.12%. This means that today’s prices are 1.51 times higher than average prices since 2000, according to the Bureau of Labor Statistics consumer price index. Of course, inflation silently erodes the buying power of your portfolio. So your initial investment of $100K now only has a buying power of $67,297 in today’s dollars. Compounded over twenty years, an inflation rate of 1.6% reduces your after tax return from 3.34% to 1.62% and investment worth to $150,925. Wow!!!

What does this all mean?

This means that if you invested $100,000 in 2000, your ACTUAL return, i.e. the kind of return you can actual BUY something with in 2020 dollars AFTER you pay brokerage fees and taxes is a mere 1.62% compounded per year. More specifically, after getting your initial investment back, you have $50,925 in net gains after twenty years.

I had no idea that even when losing money in the stock market I was still on the hook to pay broker fees, after pulling profits out (if any) I had to pay 15% capital gains tax while also losing value through inflation. I remember when I use to investment with Amerprise, I could never get a clear answer from them on what my real returns where and now understand why. They didn’t want me to know that the average person like you and I aren’t making money in the stock market. This is a big reason I no longer invest in the stock market and started to look for other ways to earn passive income.

What’s the Alternative? – “Real Estate”

You might be saying “That’s great, I appreciate you breaking this down for me. But what else is there? I’m so glad you asked, because some Foreign Service Officer believe that Single family Homes (SFH) is your only alternative in Real Estate. Even SFH rentals have their limits too. I’m going to show you a viable alternative to both SFH and the stock market with less risk and volatility, above average returns, lower taxes and a hedge against inflation.

Why not single family homes (SFH)?

Yes I agree there are Pros to SFH investing but it took me 15 years to realize that with my large SFH Rentals portfolio that I was limited on how big I could, that cash flow is not substantial, vacancies are costly and a hassle to manage while overseas. Ask me how I know.

SINGLE-FAMILY RENTALS

Most Foreign Service Officers, who are considering investing in real estate consider investing in single family rentals (SFH) first. What most FSO do is buy one or more SFH’s and either hire a property manager or become a landlord managing themselves. The challenge with this option is that it’s not very passive or cuts into your cash flow. Actively managing as a landlord, you’re responsible for finding the tenant, taking calls when something breaks, making repairs, dealing with bad tenants, etc. This is even more difficult while serving overseas. On the other hand, if you hire a property manager you are charged leasing fees and a monthly management fee anywhere from 8% to 10% monthly. Also, finding good property manager for single family rentals can be a challenge in itself. It is hard to get out of a contract with a bad property manager without having to pay for future earnings per the contract. That sure does eat into your cash flow and your time.

I also thought turnkey rentals would be a better option since most turnkeys are either new construction or fully remodeled properties that should have less repairs for the first few years of ownership. Also these turnkeys usually have a property manager that as already leased out the property with immediate cash flow. I think for FSO that are serving overseas, this is a good option but you are usually paying a higher price to purchase this property. Also, some of the turn keys that I’ve purchased did not provide the returns that the turnkey provided advertised.

Finally, SFH is very expensive when it goes vacancy. Not only do you lose each month’s rent payment when vacant but also there are leasing fees, utilities to pay to get a new tenant placed. This is a real problem with SFHs that might be in area with a market downturn. Look at what happened during the great recession of 2008: SFHs suddenly had higher vacancies as tenants fled into cheaper apartments and property values plummeted, resulting in a massive loss of capital.

The Alternative is Multifamily Investing or called Multifamily Syndication

What is a Multifamily Syndication? A multifamily syndication is where a group of people pool their resources to purchase an apartment building which would otherwise be difficult or impossible to achieve on their own. This typically involves the “general partners” who organize the syndication, including finding the property, securing financing and managing the property; the general partners are sometimes referred to as the “sponsors” or “operators”.

The group of people who are providing the cash investment are often referred to as “passive investors” or “limited partners”. In return for their investment, the limited partners receive an equity share in the syndication along with cash flow distributions and profits.

Benefits of Multifamily Syndication

There are 5 main advantages of passively investing in multifamily syndications over any other investments:

- Below-Average Risk

- Above Average Returns

- Passive Income

- Extraordinary Tax Benefits

- Inflation Hedge

. Below –Average Risk Perhaps the greatest advantage of investing in apartment buildings lies in its extremely low risk profile. For decades, the multifamily market has proven much less volatile than residential real estate, the stock market and cryptocurrency. When the housing bubble popped in 2008, the delinquency rates on Freddie Mac single-family loans soared, hitting 4% in 2010. By contrast, delinquency on multifamily loans peaked at 0.4%. The same can be said for 2020 and how multifamily has continued to be strong through the entire Pandemic. So, if you’re looking for a recession-proof way to invest your money, there is no better option than apartment building investing.

2. Above Average Returns As we’ve seen, the average stock market return over the last 20 years was 6.41% but after fees, inflation, and taxes that return becomes a paltry 1.6%. On the other hand, multifamily syndications routinely return average annual returns of 10% and above. That’s compounded (i.e. without volatility) and after fees, inflation, and yes, even taxes.

3. Passive Income Unlike stocks and bonds, multifamily syndications generate cashflow for its investors from the income generated by the property. This cashflow afforded by multifamily investing generates the kind of passive income that leads to financial freedom. (Can you say early retirement?) The brilliant part is that the multifamily asset itself is appreciating in value over time and can usually be sold for a significant profit. The combination of passive income and appreciation lends itself to the kind of generational wealth you can pass on to your children.

4. Extraordinary Tax Benefits Real estate has advantages over nearly every other investment, from stocks and bonds to business investments to precious metals. In Multifamily Syndication as a Limited Partner, you invest directly in the real estate and become a fractional owner of the property. This is important, because it positions you to take advantage of the other tax benefits of this profitable asset class. The biggest tax benefit to Multifamily investors is Cost Segregation.

What is Cost Segregation? In general, residential properties can be depreciated over a 27.5 year period based on their classification as Section 1250 property, but certain categories of assets within a building can be depreciated more quickly, over five, seven, or 15 years due to their reclassification as Section 1245 property. These include non-structural personal assets, land improvements, leasehold improvements and indirect construction costs, when applicable. Separating these faster depreciating assets into their proper categories allows for the frontloading of the appropriate tax deductions, lowering upfront payments and increasing cash flow. Which means you shouldn’t have to wait all those years to get a tax deduction for them.

The IRS allows multifamily investors to write off each year as an expense through something called “depreciation”. This is only a “phantom” expense, meaning it doesn’t actually cost you anything but it does reduce your taxable income. The reason for this is simple: the U.S. government wants people to invest in real estate; it’s actually a tax incentive, and it’s required by law. To illustrate the magic of depreciation, let’s look at this example.

The main thing to note here is that the $10,000 you put into your pocket is entirely tax free. Instead of showing a taxable income, your tax return shows a taxable loss. Amazing, isn’t it? You can even “carry forward” your “loss” to future years or you can use it to offset gains from other passive income – further reducing (or even eliminating) taxes in the future, too.

WOW! Do your stocks do this for you?

Depreciation is a benefit of ALL real estate investments, but multifamily gives you an additional tax bonus – called “bonus depreciation”. Recently Pass into law, bonus depreciation allows us to deduct the entire value of the investment from our taxable income in the first year. This produces a GIANT tax loss that we can carry forward and apply to other passive income – reducing our even eliminating taxes paid on any gain. And if we sell for a big profit at the end, we can do something called a “1031 Exchange” that allows us to defer taxes – indefinitely. No other investment on the planet offers such incredible tax benefits.

5. Inflation Hedge Multifamily investments are a fantastic hedge against inflation. If you recall, the Federal’s Reserve’s inflation target is 2% each year, which means everything goes up in costs, including rents. And as income goes up, so does the value of the property. I hear you saying “Yes, but no so fast. It’s true that rents are going up by 2% but so are expenses! And that keeps the net income of the property the same and with that the value of the property, isn’t that right?” Actually no … take a look at the following table that shows both the rents and expenses going up 2% each year, look at what happens to the Net Operating Income:

The Net Operating Income (or “NOI” for short) is going up! And the higher the NOI, the higher the value of the property. In fact that small 2% inflation rate results in a 10% average annual return on the cash invested in a typical real estate syndication. It’s like magic: the more inflation goes up, the more the apartment building appreciates – the perfect hedge against inflation!

The best investment no matter where you are overseas – by far – is passively investing in “multifamily syndications”.

Most investors invest their hard-earned money in the stock market. It’s not their fault, really, because that’s what 99% of financial advisors advise their clients to do! But as we’ve seen, the average annual returns of the stock market (after fees, inflation and taxes) are a mere 1.62% over the last 20 years. Coupled with the uncertainty of a market crash makes this investment class questionable at best. After studying every other possible alternative, I’ve come to the definitive conclusion that investing in multifamily syndications is the best investment on the planet. No other investment performed so well in the last recession and offers above average returns (including cashflow), extraordinary (and legal) tax advantages and a built-in hedge against inflation.

If you have any additional questions, please email me directly at James@jcoreinvestments.com

Have you ever heard of a Self-Directed IRA (SDIRA)?

Did you know you can invest in real estate with you IRA?

Over the years, I’ve experienced that real estate is a better investing strategy for my family compared to the stock market. Even though I personally don’t like investing in the stock market, I continued to invest in an IRA for tax deferred reason. What I didn’t know is there is a thing called “Self-Directed IRA” that gives you control over where and what you can invest your IRA in.

These investments grow tax-deferred; so, earnings can compound faster than they could outside of the account. The IRS allows a wide variety of investments choices for these accounts and the one that attracted me the most is real estate.

Here are a few examples:.

- Real estate.

- Undeveloped or raw land.

- Promissory notes.

- Tax lien certificates.

- Gold, silver and other precious metals.

- Cryptocurrency.

- Water rights.

- Mineral rights, oil and gas.

- LLC membership interest.

- Livestock

The catch is you must move your IRA from your current account to a specialized firm that offer SDIRA custody services. Most of the traditional IRA account holders do not do provide SDIRA accounts and will try to talk you out of transferring your account. The reason is they are losing the fees that they are currently charging you. There are many SDIRA custodians to choose from and they also have fees so it’s important to shop around. You also need to be aware that SDIRA custodians can’t give financial or investment advice, so the burden of research, due diligence, and management of assets rests solely with you as the account holder. They are only there to ensure that when you are investing that you are following the IRS rules to keeping this a tax deferred investment.

Lastly, the most important thing to be aware of when investing in Real Estate with your SDIRA is you still could be taxed because of what is called an Unrelated Business Income Tax (UBIT). This tax comes from any of the funds that you leverage to purchase the property.

If your IRA took out a loan to purchase property, any earnings yielded from the leveraged portion of the asset (referred to as Unrelated Debt-Financed Income or UDFI) may incur UBIT. For example

- Your IRA holds a rental property. It paid cash for half and financed the other half (50%).

- The rental property earns $10,000 in a given year. Since the debt percentage is 50%, half of those earnings ($5,000) will be taxed at the current UBIT rate.

The debt percentages from each of the previous 12 months will be averaged to represent the single debt percentage for that year. Profits garnered from the sale of a debt-leveraged property will also be subject to UBIT, but not at the current Trust Rate. Such profits would be taxed as capital gains.

If you have any additional questions, please email me directly at James@jcoreinvestments.com

6 Amazing Reasons You’ll Love Passively Investing in Multifamily

Over the years, I have learned that investing in single-family homes (SFH) would not get me to the financial freedom I was seeking, especially while serving overseas. For example, trying to research new markets, find that next investment property, complete the due diligence, and form the team to fix and manage my rental property took up a lot of my time and effort. These are just a few of the challenges that investing in single family rentals presented.

While serving overseas, I became even more frustrated as my SFH investing plateaued but luckily I was introduced to Multifamily real estate. In just one year, I was passively invested in over 4 different apartment complexes (over 1000 doors total) and learned quickly that multifamily allowed me to 10X my rate of investment.

When I speak about investing in multifamily real estate, many people do not even know that there are options available in these investment vehicles. For the longest time, I never even considered the idea of large apartments deals since I didn’t have the capital or experience to purchase a multifamily complex. I was very stubborn to look at anything other than SFH, until a mentor introduced me to the idea of Multifamily Syndication.

My mentor opened my eyes to that fact that there are opportunities to passively invest in multifamily real estate while still enjoying all the benefits of real estate investment. I remember him saying “every time you drive by an apartment complex just think that someone owns that property, why can’t it be you?”

To get in on Multifamily investing, I invested Passively in a Multifamily Syndication as a Limited Partner. Passive investing is an approach for investors who are looking to establish long-term financial returns while minimizing their time investing. By investing in multifamily syndication, you can enjoy the six benefits listed below, and more, of this investment class.

- Time – Let’s face it, your time is one of your most valuable resources, and you should spend it on doing things you love. By investing passively, sponsors like JCORE Partners are spending the time to find the right property and execute a sound business plan so that you focus on doing other things. (we like to call this making money in your sleep, a.k.a. mailbox money!)

- Tax Benefits – Like any investment, you should anticipate some sort of return, but along with the opportunity to earn income, investing in multifamily properties offer several tax benefits to investors. Taking advantage of these tax benefits allows you to increase cash flow in the short term while maximizing tax savings.

- Diversification – The most commonly cited reason for investing in multifamily real estate is portfolio diversification. Meaning you are looking to add real estate to your investment portfolio. You can also diversify your real estate investments across several properties in different areas with different property types and other sponsors. Doing so keeps you from over-allocating assets to any one group and will help you learn what you do and do not like from a multifamily sponsor.

- Liability – With syndications, one of the greatest benefits to investing passively is that you have no liability beyond your investment.

- Philanthropy – With most investments, only you or your family are receiving the benefits of the investment. However, when you invest in a multifamily syndication, you have the opportunity to not only receive monetary returns but positively impact the lives of many families. Each multifamily syndication we execute aims to create a clean, safe, and pleasant place for people to live. Doing so also has a positive influence on the community and environment. This is a benefit you typically do not see from investing in stocks or bonds.

- Leverage – When you invest in multifamily syndications, it all comes down to leverage. In this instance, we define leverage as using something to its maximum advantage. Leverage allows you to use various instruments of the sponsor to increase the potential return of your investment. Passive investing enables you to leverage things like experience, knowledge, research, time, network, teams, and ability to syndicate with other like-minded investors to take down large multifamily deals.

Passively investing in multifamily real estate is a great way to diversify your portfolio and mitigate risk. It allows you to use your most finite resource, time, on the things you love instead of doing so much effort to find that next SFH investment. Also, you aren’t involved at all with fixing toilets, screening tenants, or handling the day-to-day operations of your SFH property. You benefit from several tax advantages, have minimal liability, and positively impact many families and communities. That said, we hope that this article helps you build a stronger foundation in making an informed investment decision.

What are a few Key Terms to know when evaluating a Multifamily Syndication Investment?

There are so many factors to consider when evaluating a potential investment and at times it can be overwhelming, especially for those who may be investing in their first real estate opportunity. Investing in real estate is not rocket science and sometimes it’s just about gaining a little clarity on what you are looking for. Here are a few Key Terms you should be taking into consideration when breaking down a multifamily investment.

First off, what is a Multifamily Syndication?

Multifamily Syndication is where a group of people pool their resources to purchase an apartment building which would otherwise be difficult or impossible to achieve on

their own. This typically involves the “General Partners” who organize the syndication, including finding the property; the general partners are sometimes referred to as the “sponsors”. The group of people who are providing the cash investment are often referred to as “passive investors” or “limited partners”. In return for their investments, the limited partners receive an equity share in the syndication along with cash flow distributions and profits.

KEY TERMS

Preferred Return (My Favorite)

A Preferred Return is a set return percentage to be paid to investors each year based on how much money they have invested. This is the minimum average annual return the investor can expect to receive. If the investment does not generate enough Net Profit to pay this Preferred Return in any given year, the amount of unpaid Preferred Return is rolled forward to the next year. Until all Preferred Returns are paid to investors, the GP team cannot take any Equity Distributions (meaning they don’t make any profit until the investors do).

Example: A 8% Preferred Return on a $100k investment equals a payment of $8,000 per year. If the investment can only pay that investor $4k in the first year due to renovation expenses, for example, the unpaid $4k is rolled forward and the GP owes the investor $12k the following year ($8k for the Year 2 Return + the unpaid $4k from Year 1).

Cash on Cash Return COC

A measurement of profitability often used in real estate transactions to assess short-term profitability, usually for a one-year period. The calculation determines the rate of investment income relative to the amount of money invested.

CoC Return can be increased either by increasing income received during the year or by reducing the number of dollars invested. A strong CoC comes from getting solid income from a small investment.

Net Operating Income

Net operating income in real estate is the money a property generates minus operating expenses. It is used to evaluate how much cash flow an investor can expect to earn from an investment property after operating expenses and vacancy losses.

There are certain costs that qualify as operating expenses and others that don’t. Operating expenses that should be deducted might include property tax, insurance, repairs and maintenance.

NOI doesn’t include depreciation, capital expenses, loan interest and loan payments, depreciation and amortization.

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is a profitability metric used to asses the anticipated annualized return generated by an investment over time. IRR is a complex calculation that takes into account the amount invested, annual return distributions, and anticipated profit from the sale of the property in the future.

Importantly, IRR also incorporates the ‘time value of money’, meaning that it takes into account the increased

potential earning power investors enjoy due to 1) the early return of investment capital through refinancing and 2) earning annual income distributions rather than one lump sum payment at the end of the investment term. Receiving income or returned capital sooner means the investor has more time to use that money for other investments, which we call Opportunity Return.

Because IRR takes into account so many factors, it’s an easy way for investors to compare different kinds of investments at a glance. The higher the IRR, the better.

Multifamily is the Best Passive Investment on the planet?

Where else can you get these benefits?

*Below-Average Risk: When the housing bubble popped in 2008, the delinquency rates on Freddie Mac single-family loans soared, hitting 4% in 2010. By contrast, delinquency on multifamily loans peaked at 0.4%. So, if you’re looking for a recession-proof way to invest your money, there is no better option than apartment building investing.

*Above Average Returns: As I describe in the Special Report, the average stock market return over the last 15 years was 7.04% but after fees, inflation, and taxes that return becomes a paltry 2.5%. On the other hand, multifamily syndications routinely return average annual returns of 10% and above. That’s compounded (i.e. without volatility) and after fees, inflation, and yes, even taxes.

*Passive Income: Unlike stocks and bonds, multifamily syndications generate cashflow for its investors from the income generated by the property.

*Extraordinary Tax Benefits: Because of the magic of “bonus depreciation”, your investment income is taxed at a much lower rate than any other investment (in fact, you may actually show a taxable loss that can be used to offset other passive income!).

*Inflation Hedge: As inflation increases, so does the value of the property – the perfect hedge against inflation.

Bottom-line investing in multifamily syndication is the BEST Passive Investments on the planet.

Good Bye 2020

No one could have predicted the tumultuous year that 2020 turned out to be. However, from a multifamily standpoint, it was not as catastrophic as we feared in March and April. Some properties have suffered slightly lower collection rates as tenants lost jobs. At the same time, most tenants made it a priority to continue to pay rent. While there still is a federal eviction moratorium in place, rent is not canceled and almost all operators have been able to work with tenants to put them on payment plans if they fell behind.

We also continue to see a tremendous appetite for multifamily investments. Investors are looking for a return on their capital, and the returns on bonds, savings accounts, and CDs are so low that they don’t keep up with inflation.

Therefore, there continues to be an interest in investing in real assets. Low interest rates also make the multifamily attractive. Of course, this continued interest in the asset class makes it hard to find good deals, but our JCORE Team continues to develop broker and owner relationships so we can find a deal that makes sense to offer to our investors.

Why we love Dallas

Dallas Fort-Worth is one of the most resilient MSAs in the nation with a diverse economy, affordable living, and lower costs of doing business. The region is a top choice for multifamily investors due to its rapid population and job growth, leading the nation for several consecutive years. The graph below illustrates the demand for apartments in the DFW area - it's off the charts, literally!

Similarly, job losses in the DFW market have been less than any other major metro area in the country. All 12 of the nation’s largest metro areas had year-to-date job losses. Seven metros exceeded the national average of 7% - with New York and San Francisco leading the losses at over 11% each. Phoenix and Dallas were basically tied for the least job losses at 3.5% each - that's less than one-third the job losses or those two leaders and less than half the loss of the national average! Economic resiliency is key for investing in multifamily.

DFW is a leader in transportation and logistics. Dallas leads the job growth in the US. DFW has one of the most diverse economies in the country and it actually leads the country in net migration by adding over 1 million residents since 2010! I could go on and on but you get the point. We're not seeing any discounts in the Dallas market but there's a reason - the facts just don't justify it. With rates low and opportunities still in the market, we plan to continue moving forward.

Some Huge Personal News

If you’re reading this, I’ve been fortunate enough to connect with you over the past few years. And since we’re connected, it’s time to update you on some recent changes along with why I’m so excited about the future.

I’m beyond grateful for the support of my wife and family and the education and mentorship I’ve received from so many amazing people in my military career as well as in my Real Estate Investing ventures. This support has enabled me to achieve so many amazing milestones and set my family up for financial success for years to come.

It’s also a large part of the reason why I’ve formed a Real Estate Investing partnership with several other current and former military investors, the ‘JCORE (Joint Chiefs of Real Estate) Partners.’ We are dedicated to bringing you valuable investing education and passive investing opportunities.

As military members, we understand the demands of a busy work life, travel, family, and deployments. We acknowledge that not everyone has the time and knowledge to invest ‘hands on’ in Real Estate. Therefore, we have partnered to provide solutions through Apartment Syndications- a truly passive way to invest in Real Estate. We work to acquire, manage and operate large Apartments so that you can collect mailbox money and focus your attention on your career and family.

If you’re somebody who values your time and your financial future, then please visit our website at https://www.jcoreinvestments.com/ to access our FREE Multifamily Investing Masterclass Interviews and to schedule a call with me or one of my partners.

In spite of the challenges of 2020, we have seen tremendous success and our momentum is building! I want to thank you from the bottom of my heart for your connection, time and interest. Please don’t hesitate to reach out and let me know if there is anything I can do for you personally or professionally.

Signing Off,

Noel