What We Are Thankful For

What the JCORE Team is Thankful for in 2022.

Teams are central to accomplishing your goals, and this is no different in real estate. The JCORE team has been working together for the past few years and as we reflect on 2022, we wanted to share a few things we are thankful for this season.

Tom Groves

This year, I am thankful for so much growth professionally and personally. My daughter got engaged in September, my wife and I have attended the Pay it Forward conference in Denver (we’re looking forward to the next one), and our team has bought and sold properties in Texas and Pennsylvania. I thank God for such an amazing opportunity to work with JCORE and and great people across our country!

Noel Walton

This year, I am thankful for, The support of my family, the abundance of amazing relationships I’ve made in this business and the ability to make a difference in the lives of Veterans along the way.

James May

This year, I am thankful for my family and the great year we had together. We are really enjoying being back in the U.S and starting a new life here in Florida

Myles Spetsios

This year, I am thankful for my wife who works hard as an interventionist teacher and is a great life partner. I’m thankful for my in-laws and nieces who had us over for Thanksgiving and cooked a wonderful meal. I’m thankful for my job that allows me the honor to serve my country

I’m thankful for my dogs that are super adorable and always brighten my day

Joey Arora

This year, I am thankful for the opportunity to work on financial freedom with a great team of fellow veterans. The chance to grow and work together in a virtual environment has been a joy in my life. I have enjoyed working in the commercial space and the chance to visit India with my family this year.

We also want to give a thank you to all the investors who have trusted us with their capital in 2022. This journey happens because of you! To join our investor club visit: https://join.jcoreinvestments.com/investorclub

-Thank you from the JCORE Team!

Want to Learn more about JCORE:

We have created a system for you to invest directly into cash-flowing, hard assets that don’t require you to manage tenants or deal with any of the headaches that come from owning Single Family Homes. This gives you the freedom to use your time as you wish while we grow your wealth through these amazing assets!

If you are looking to secure your financial future, we would love to connect with you and explore partnership opportunities!

To Learn More about the many benefits of investing in Multifamily Apartments, Download our Free Passive Investor Guide today!

You can set up a complimentary discovery call to join our investor network with one of our team members here!

What is a Real Estate Syndication

What is a Real Estate Syndication?

The concept of a real estate syndication is not difficult to grasp especially if you’ve ever played poker.

In a syndication, you’re throwing money into a “pot” with others with the difference being in poker, you’re trying to win the entire pot.

In a syndication, you’re able to split the pot with the other players (investors) in a deal including the dealer (syndicator).

This “pot” of money is used to purchase property (apartment buildings, hotels, self-storage facilities, etc.) and hold for an extended period of time.

By “joining forces” with other investors, this type of investing becomes a team sport where everyone wins.

Basics of Real Estate Syndication

So when I get the question, “James, how does a real estate syndication work?”, I typically will compare it to traveling on an airplane.

There are several groups of people involved such as:

- pilots

- passengers

- flight attendants

- mechanics

- luggage and ground crew

Using this analogy, the deal sponsor of a syndication are the pilots and you and I (passive investors) represent the passengers.

Even though both groups are traveling to the same destination, each have considerably different roles during the process.

If surprises occur such as unexpected weather conditions or engine problems, it’s the pilots who are responsible for the flight.

They’re the ones who will monitor and update the passengers during the flight:

(“Good afternoon, this is your captain speaking. We’ve hit an area of turbulence but should be through it shortly….”).

And it’s the passengers job to sit back and allow the pilots to make the decisions on what’s best to flying the plane.

Make Sense?

“90% of millionaires become so through owning real estate.” – Andrew Carnegie

Hopefully you now get a gist of what’s involved during this process as real estate syndication deals works much the same way.

There’s several groups of people that all share a vision and want to improve a particular asset such as:

- Sponsor (general partner)

- Passive investors (limited partners)

- Brokers

- Property management

However, each person’s role within the project is different.

Let’s take a look at the two main groups involved:

#1 General Partner (GPs)

They’re also known as the sponsor group and typically:

- find the deal(s)

- get it under contract

- arrange inspections

- evaluate the numbers

- obtain financing

- keep it leased

- manage the property

#2 Limited Partner (LPs)

This group is made up of those that choose to invest passively with limited risk.

Remember, they have no active responsibilities in managing the asset.

How can you profit from a Real Estate Syndication?

Now that you understand the basic operation of how a syndication works, let’s discuss how you can profit from investing in this type of deal.

Profit in any type of real estate opportunities, regardless of a syndication or not, comes from:

- rental income

- appreciation

Profit is generated when the operating costs of the property are LESS than the rents collected.

This is known as the NOI or net operating income which represents the cash flow distributed to the limited partners via distributions (monthly or quarterly).

Investors will receive an additional benefit as typically a property’s value usually appreciates over time. Because of this, the investors can net higher rents and earn larger profits when the property is sold.

Syndication example

In order to drive this concept home, let’s use an example.

Let’s say that you’ve been researching about the syndication process via blogs and other forums and decide to jump in and invest.

A group buys a 350-unit apartment complex in Charlotte, NC for the purchase price of $50 million.

Everything you need to know is outlined in the Private Placement Memorandum (PPM) which you read BEFORE investing.

You learn that the bank financing the deal requires a 30% down payment ($15M). Of this amount, the sponsors cover $1.5M and then they raise money from limited partners (LPs) for the remaining $13.5 million of the required equity.

A syndication is now formed (Limited Liability Company or LLC) between the general partners and limited partners and the apartment complex is purchased.

The projected hold time for this project was initially set forth at 5 years. During this time period, the business plan including “forced appreciation” as it was a value-add deal.

Improvements to the property were made such as:

- upgraded fixtures

- new flooring

- granite countertops

- stainless steel appliances

- new cabinets

- new signage

- update fitness center

- rehab existing pool

- parking lot upgrades

- painting (interior and exterior)

- new landscaping

- internet and wifi update

During this time period improvements were being made, the rents were gradually raised to the same amounts being charged by other local apartments with the same amenities.

Due to the increased rental income, the syndication sends the passive investors a share of the profits from the rental properties every quarter. (Profit #1 rental income)

After five years, a buyer is found and the complex is sold for $15 million ($65M) over the original sales price.

At this time, the limited partners get back their initial investment plus a share of the $15 million profit from the sale. (Profit #2 appreciation)

Remember, during this five year hold period, all of the passive investors received distributions on a quarterly basis from the profit made with the rental income.

What’s the Investing Process?

The next logical question you’re probably asking yourself is, “How do I invest?”

Here are the steps for getting into the syndication game.

- The sponsor sends out a “deal offering” email that an investment is open.

- Review the offering memorandum (property description) and make an investment decision.

- Submit the amount you want to invest to the sponsor.

- The sponsor holds an investor webinar, where you can get more information and ask questions.

- The sponsor confirms your spot in the limited partnership and sends you the PPM (private Placement memorandum)

- Fund the deal via wire or check.

- The sponsor confirms that your funds have been received.

- You’ll receive a notification once the deal closes and what to expect next.

Multi-family prices will not come down significantly.

Multi-family prices will not come down significantly

We know that Commercial Real Estate Investments have some of the best advantages for returns when compared with Residential Real Estate. In this new post-COVID higher interest rate market, our strategies for buying apartments is changing. Here is what we see, and what we are doing.

If you think we are on the precipice of another 2008, keep waiting, I’ll keep buying. It makes for good rhetoric, but this is not going to happen.

Here is why;

- More demand than supply, this is still increasing in the areas we buy in.

- Rents are still going up-they will not fall. Look at the historical MF Rent charts for the last 50 years. Rents don’t do down. Ever.

- Increase in rents continue to drive NOI and values.

- Sellers have been “price anchored” by 2021. They think their properties are worth a lot, and they won’t take significantly less.

- Single Family housing is more expensive now. Rates are making housing MORE unaffordable. We are seeing, and will continue to see, a shift in the total economy. The American dream is dying. The house and white picket fence? Not anymore. Now its the 2 bedroom with a community pool in a pet-friendly complex.

Multifamily prices have come down a bit, this is true, but are a far cry from the bloodbath of 2008.

Our Strategy – Focus on debt, not the purchase price.

This is how you are going to get ahead in this cycle and be looking smart in the next 5-10 years.

Here are the tactics;

1) Lots of great debt was placed over the last 3 years. Take advantage of it. Assumption loans used to be the red-headed stepchild, now they are the prom queen. If you have to pay more to assume a loan of 3.63% with a 7-10 year fixed term, pay it. Run your underwriting taking into account your new debt will now be 5.5%-6.5%, and over 8% for bridge!

2) Get the seller involved. Sellers want a high price, so get them on the equity side of your deal. Offer them a piece of the new deal, or maybe a promissory note, or pref equity. Every dollar they finance to you is a dollar you don’t have to raise, a % of equity not given away, and bump in IRR for your investors.

3) Shy away from the heavy lifts. Cash is king, and they need lots of it. Big remodels don’t work with assumptions typically. Grab the operational play, bump those rents, pay down the loan, and ride the inflation wave.

4) Inflation is your friend, not the enemy. For every dollar your rent rises, your long term fixed debt becomes easier to pay off. In fact, the “powers that be” know this, and because inflation benefits the wealthy land and business owners, it will always just be a political talking point. Remember-they will never stop inflation. Grab as much good debt as you safely can, and manage your costs.

What This Means For You

We have created a system for you to invest directly into cash-flowing, hard assets that don’t require you to manage tenants or deal with any of the headaches that come from owning Single Family Homes. This gives you the freedom to use your time as you wish while we grow your wealth through these amazing assets!

If you are looking to secure your financial future, we would love to connect with you and explore partnership opportunities!

To Learn More about the many benefits of investing in Multifamily Apartments, Download our Free Passive Investor Guide today!

You can set up a complimentary discovery call to join our investor network with one of our team members here!

How Does Inflation Affect Us?

Many of you have asked me if I’m worried about inflation. Yes, I am, kind of.

Here’s the deal – when there’s inflation you want to be invested in hard assets. Quality hard assets – like gold. They tend to weather the inflationary storm pretty well. But they may not provide current cash flow – or you may need to sell when they’re down. That would be painful. The catch is owning cash flowing hard assets that aren’t over-leveraged. They weather the storm and come out looking great! That sounds a lot like Multifamily! And there’s a massive shortage in housing so we’ve got two things going for us. If inflation kicks in, the cost of construction gets higher, which continues to put a lid on new development.

I’m more concerned about jobs and wage growth. If wage growth can’t keep up with rent growth, the affordability crisis, at some point, becomes a rent crisis. I don’t think we’re there at a scale that would cause fundamental issues, but I would like to see some sustained wage growth in excess of inflation – and we really need to see the bulk of this growth at the lower to mid end of the scale. These are our renters. Chairman Powell, thankfully, has also stated this as one of his top goals. And, of course, multifamily is driven by jobs so clearly we need the economy to continue to grow and thrive in general with positive job creation. Based on past actions that the Fed and Congress have taken, I highly doubt they will do something to ruin this. Bad tax policy, COULD, so we have to keep a close eye on that. Businesses MUST continue to be incentivized to invest and grow!

With that backdrop, we continue to believe multifamily is a great investment. Obviously the experience of your sponsor/operator is paramount, but the fundamentals continue to look solid. Invest responsibly. Invest often.

If you would like to learn more about Multifamily Real Estate and how to invest, please email me directly at James@jcoreinvestments.com

The Importance of Time Value of Money

You’ve probably heard about the importance of time value of money.

But do you know what it really means?

What Is The Time Value of Money?

The time value of money (TVM) is a useful concept that enables you to understand what money is worth in terms of, you guessed it, time. This is expressed in a formula which basically states that money is worth more NOW than it will be in the future. This is mainly due to inflation which increases prices over time and decreases your dollar’s spending power. Many of the financial decisions we make now and in the future involve the importance of time value of money.

Examples include:

- taking out a 15 vs 30 year mortgage

- buying a car on credit (no thanks)

- investing in stocks, mutual funds or bonds

Inflation Examples

Here’s a handful of examples of how inflation increase the price on everyday items.

First Class Stamp – Back in the mid-80’s, you could mail a letter for 22 cents. That same letter today will cost you 55 cents to mail thanks to inflation.

Ticket to a movie – If you wanted to go see a movie back in 1985 such as Back To The Future or Rambo: First Blood Part 2, you’d have to shell out $3.55 per ticket. That same ticket today is right around $13.00. If you throw in popcorn and coke then you may have to borrow money from your kids!

Honda Accord – One of the most popular cars in the ’80s was the Honda Accord. Back then the base price was $8,845. Today one can be yours for $24,770.

Human Nature

It seems like kids grasp the concept of the time value of money better than adults. Don’t believe me? Try asking one if they’d rather have $100 now or pay them 10% interest and give them $110 a year later. How many would wait? I’d guess close to zero. Heck, most adults wouldn’t either!

I think that many savvy investors are starting to grasp this concept and changing the way they invest. Instead of socking away money that will be locked up in a 401K for 30+ years, they are investing for cash flow that can replace their expenses now (accumulation model vs cash flow model).

Why?

Because they want options NOW and know that buying stuff is only going to become MORE expensive each year. They’d rather have that money now rather than later.

Why Is the Time Value of Money Important?

Remember that Inflation increases prices over time so every dollar in your pocket today will buy MORE in the present than it will in the future. This makes investing even more important than most realize.

The TVM helps in that it allows you to make the best decision about how to handle your money based on:

- inflation – Inflation causes the cost of goods and services to continue to rise. You can buy more with $100 now than in twenty years. Money you have today has a higher purchasing power.

- risk – You understand that a lot can happen in the future. Due to unforeseen circumstances, you may not get all of your money, or any at all. But you can lower your risk to zero if you’re paid today.

- investment opportunity – There are a lot of ways you can make your money grow today (real estate investing). But if you wait ten years to receive your money, you’re losing the opportunity to invest.

The Importance of Time Value of Money in Real Estate Investing

You didn’t think a real estate investing blog would leave out how the TVM could help them too now did you? Real estate investors can use this concept to help determine what future cash flow from a real estate investment would be worth in today’s dollars. It can also help to determine whether you’re better off using your cash now for something such as a rehab, or borrowing money and conserving cash for another purpose.

The Importance of Compounding Interest

Even though we now know that the TVM teaches us that money is worth MORE today than in the future so we should spend it now versus save it for later; we also know that sometimes that isn’t the case. While inflation works against you, eating away at the value of your money, compound interest works for you to raise the value of your present dollar tomorrow.

What Is Compound Interest?

Compound Interest is simply earning interest on interest.

In other words, it works by calculating the interest on your entire account balance which also includes the interest that’s been accrued. Here’s a compound interest formula:

For example, if you have $1,000 and it earns 10% each year for five years, in the first year you’ve earned $100 in interest (10% of $1,000).

In year #2, things start to pick up as you’re actually earning interest on the total amount from the previous compounding period, which would be $1,100 (the original $1,000 plus the $110 in interest earned in year one).

By the end of year two, you’d have earned $1,210 ($1,100 plus $110 in interest). If you keep going until the end of year five, the original $1,000 turns into $1,610.

The Time Value of Money Formula

Now that we’ve learned what the importance of the time value of money is, how then do we go about measuring it?

We do so by using a specific formula which takes the present value, multiplies it by compound interest for each payment period and factors in the time period when the payments are made.

Formula: PV = FV / (1+I)^N

- PV: present value

- FV: future value

- R: rate of growth or interest rate

- N: number of periods (typically measured in years or months)

Using the Time Value of Money Formula

I get it. Who wants to use a complex formula? It’s essential if you want to answer questions such as:

How much would I need to save beginning today if I want to become a millionaire in 20 years, assuming a 7% growth after inflation?

You could also use this formula to calculate anticipated future costs like college, purchase of a home, weddings, etc.

If I start with with an account balance of zero today and put away $500 a month, what will I have in 10 years if I get a 6% growth after inflation?

This is a great way to see the direction you’re headed in.

Using this calculation with kids is a GREAT way to motivate them to focus on saving money at an early age.

Here’s an online calculator that you can use to speed up calculations.

Conclusion

Now you’ve come to realize the importance of the time value of money and that it tells us that money we have now doesn’t have the same value in the future. By knowing this, we’re able to make we’re able to set goals and make choices that affect our financial life.

If you would like to learn more about Multifamily Real Estate and how to invest, please email me directly at James@jcoreinvestments.com

Inflation in Multifamily

For those of you who follows financial or political news, you may have seen a lot of recent chatter about inflation. Most people view high inflation as a bad thing. Just look how the cost of a cup of coffee has increased over the years. It causes the cost of goods to go up making everyday life more expensive. But how does it affect investments in apartment complexes?

I personally see inflation as a good thing in our investment space. The reason for this is the time value of money. As you may know, money today is worth more than money tomorrow. This is primarily because of inflation. If we have 5% inflation in the cost of goods a year from now, you would require $1.05 a year from now to be equal to $1 today. In addition, because we generally go with a fixed interest rate, rising inflation only serves to benefit us. Imagine a scenario where we are paying interest only on a loan of 3% and there is a 5% year-over-year inflation rate. We essentially just profited on our loan because we came out ahead on loan rate vs interest rate. This works because if I borrow a $1 from you today and owe you $1.03 a year from now, however due to inflation that money is worth $1.05 now, we just made $0.02.

Now, realistically that won’t happen because the Fed has indicated if inflation were to begin to take off, they would work hard to reel it back in, but, the higher inflation goes the narrower the gap becomes it and our interest rates which benefits us and our leveraged capital

If you would like to learn more about Multifamily Real Estate and how to invest, please email me directly at James@jcoreinvestments.com

What's better the Stock Market or Real Estate?

Foreign Service Officers are well positions for retirement with the 3-Legged Stool – “FERS + Social Security + TSP.” The question is do you want to wait till retirement to start earning passive income. There are so many options out there to invest so what’s better the Stock Market or Real Estate?

What if I told you there is a way you can take total responsibility for your financial outcomes NOW, and can keep those fees that Wall Street & the IRS would of taken year after year from stock market investing. This Blog will provide an alternative that you may have never considered that provides immediate cash flow, higher returns with less headaches. Also very easy to manage especially while serving overseas. And NO the Stock Market isn’t going to get you there.

But what about your other investments in the stock market? Are you concerned about the future of the stock market? If so, you’re not alone. How can you possible plan for your financial future with the uncertainty and volatility of the stock market. After exploring the Pros and Cons in investing in the stock market, I’ll suggest an alternative for you to consider and NO its not Single Family Homes (SFH) either.

I know many Foreign Service Officers are purchasing SFH rentals using their disposable income while stationed overseas or turning their primary house into a rental properties to earn passive income. This is a great introduction into real estate but have you ever considered Multifamily Real Estate Investment?

Before getting in Multifamily, let’s review my I no longer invest in the Stock Market nor Single Family homes.

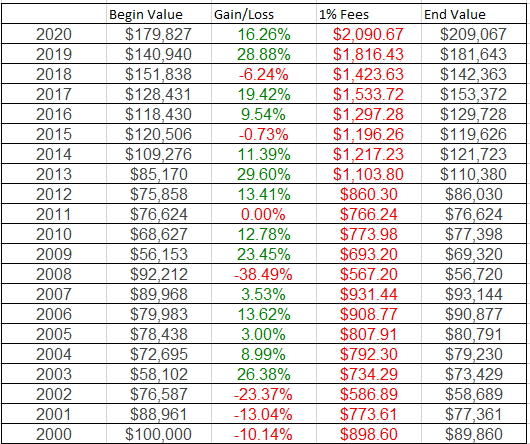

Stock Market returns will surprise you. The average stock market return over the last 20 years from the S&P 500 was 6.41% (from 2000 to 2020) and 9.65% over the last 30 years (from 1990 to 2020) [1] That means that if you invested $100,000 in 2000 it would be worth $346,456 in the end of 2020 – not bad right? But wait…not so fast.

Market volatility can crush your returns. What most investors don’t realize is that the same $100,000 isn’t actually worth $346,456 twenty years later – that’s because of the volatility of the stock market from year to year. In fact, that same $100,000 was actually worth $255,891 – which is only 4.81% return compounded every year. Not nearly as good but still not bad … until we realize these returns are BEFORE brokerage fees.

Fees stealing you blind?

The average expense ratio for actively managed mutual funds is between 0.5% and 1.0% and can go as high as 2.5% or even more. For passive index funds (ETFs), the typical ratio is approximately 0.2%[2]. Most investors have a blended portfolio of ETFs and mutual funds, so let’s assume the average fee is 1.0% per year.

After taking out a 1% fee each year, instead of being worth $346,456, your $100K invested twenty years ago is now only worth $209,066 – a mere 3.77% compounded return!

What makes it even worse is you still have to pay fees even if you lost money that year.

Let’s not forget taxes!

If you’re filing jointly and making more than $77,201, your long term capital gains rate is 15%. If you sold your entire portfolio, the taxes you’d have to pay would push your average annual return from 3.77% to 3.34%. Reducing the worth to $192,707. ($100K Initial investment + $92,707 Net Gain after 15% taxes)

Inflation – The Silent Killer

The dollar had an average inflation rate of 1.99% per year between 2000 and today, producing a cumulative price increase of 51.12%. This means that today’s prices are 1.51 times higher than average prices since 2000, according to the Bureau of Labor Statistics consumer price index. Of course, inflation silently erodes the buying power of your portfolio. So your initial investment of $100K now only has a buying power of $67,297 in today’s dollars. Compounded over twenty years, an inflation rate of 1.6% reduces your after tax return from 3.34% to 1.62% and investment worth to $150,925. Wow!!!

What does this all mean?

This means that if you invested $100,000 in 2000, your ACTUAL return, i.e. the kind of return you can actual BUY something with in 2020 dollars AFTER you pay brokerage fees and taxes is a mere 1.62% compounded per year. More specifically, after getting your initial investment back, you have $50,925 in net gains after twenty years.

I had no idea that even when losing money in the stock market I was still on the hook to pay broker fees, after pulling profits out (if any) I had to pay 15% capital gains tax while also losing value through inflation. I remember when I use to investment with Amerprise, I could never get a clear answer from them on what my real returns where and now understand why. They didn’t want me to know that the average person like you and I aren’t making money in the stock market. This is a big reason I no longer invest in the stock market and started to look for other ways to earn passive income.

What’s the Alternative? – “Real Estate”

You might be saying “That’s great, I appreciate you breaking this down for me. But what else is there? I’m so glad you asked, because some Foreign Service Officer believe that Single family Homes (SFH) is your only alternative in Real Estate. Even SFH rentals have their limits too. I’m going to show you a viable alternative to both SFH and the stock market with less risk and volatility, above average returns, lower taxes and a hedge against inflation.

Why not single family homes (SFH)?

Yes I agree there are Pros to SFH investing but it took me 15 years to realize that with my large SFH Rentals portfolio that I was limited on how big I could, that cash flow is not substantial, vacancies are costly and a hassle to manage while overseas. Ask me how I know.

SINGLE-FAMILY RENTALS

Most Foreign Service Officers, who are considering investing in real estate consider investing in single family rentals (SFH) first. What most FSO do is buy one or more SFH’s and either hire a property manager or become a landlord managing themselves. The challenge with this option is that it’s not very passive or cuts into your cash flow. Actively managing as a landlord, you’re responsible for finding the tenant, taking calls when something breaks, making repairs, dealing with bad tenants, etc. This is even more difficult while serving overseas. On the other hand, if you hire a property manager you are charged leasing fees and a monthly management fee anywhere from 8% to 10% monthly. Also, finding good property manager for single family rentals can be a challenge in itself. It is hard to get out of a contract with a bad property manager without having to pay for future earnings per the contract. That sure does eat into your cash flow and your time.

I also thought turnkey rentals would be a better option since most turnkeys are either new construction or fully remodeled properties that should have less repairs for the first few years of ownership. Also these turnkeys usually have a property manager that as already leased out the property with immediate cash flow. I think for FSO that are serving overseas, this is a good option but you are usually paying a higher price to purchase this property. Also, some of the turn keys that I’ve purchased did not provide the returns that the turnkey provided advertised.

Finally, SFH is very expensive when it goes vacancy. Not only do you lose each month’s rent payment when vacant but also there are leasing fees, utilities to pay to get a new tenant placed. This is a real problem with SFHs that might be in area with a market downturn. Look at what happened during the great recession of 2008: SFHs suddenly had higher vacancies as tenants fled into cheaper apartments and property values plummeted, resulting in a massive loss of capital.

The Alternative is Multifamily Investing or called Multifamily Syndication

What is a Multifamily Syndication? A multifamily syndication is where a group of people pool their resources to purchase an apartment building which would otherwise be difficult or impossible to achieve on their own. This typically involves the “general partners” who organize the syndication, including finding the property, securing financing and managing the property; the general partners are sometimes referred to as the “sponsors” or “operators”.

The group of people who are providing the cash investment are often referred to as “passive investors” or “limited partners”. In return for their investment, the limited partners receive an equity share in the syndication along with cash flow distributions and profits.

Benefits of Multifamily Syndication

There are 5 main advantages of passively investing in multifamily syndications over any other investments:

- Below-Average Risk

- Above Average Returns

- Passive Income

- Extraordinary Tax Benefits

- Inflation Hedge

. Below –Average Risk Perhaps the greatest advantage of investing in apartment buildings lies in its extremely low risk profile. For decades, the multifamily market has proven much less volatile than residential real estate, the stock market and cryptocurrency. When the housing bubble popped in 2008, the delinquency rates on Freddie Mac single-family loans soared, hitting 4% in 2010. By contrast, delinquency on multifamily loans peaked at 0.4%. The same can be said for 2020 and how multifamily has continued to be strong through the entire Pandemic. So, if you’re looking for a recession-proof way to invest your money, there is no better option than apartment building investing.

2. Above Average Returns As we’ve seen, the average stock market return over the last 20 years was 6.41% but after fees, inflation, and taxes that return becomes a paltry 1.6%. On the other hand, multifamily syndications routinely return average annual returns of 10% and above. That’s compounded (i.e. without volatility) and after fees, inflation, and yes, even taxes.

3. Passive Income Unlike stocks and bonds, multifamily syndications generate cashflow for its investors from the income generated by the property. This cashflow afforded by multifamily investing generates the kind of passive income that leads to financial freedom. (Can you say early retirement?) The brilliant part is that the multifamily asset itself is appreciating in value over time and can usually be sold for a significant profit. The combination of passive income and appreciation lends itself to the kind of generational wealth you can pass on to your children.

4. Extraordinary Tax Benefits Real estate has advantages over nearly every other investment, from stocks and bonds to business investments to precious metals. In Multifamily Syndication as a Limited Partner, you invest directly in the real estate and become a fractional owner of the property. This is important, because it positions you to take advantage of the other tax benefits of this profitable asset class. The biggest tax benefit to Multifamily investors is Cost Segregation.

What is Cost Segregation? In general, residential properties can be depreciated over a 27.5 year period based on their classification as Section 1250 property, but certain categories of assets within a building can be depreciated more quickly, over five, seven, or 15 years due to their reclassification as Section 1245 property. These include non-structural personal assets, land improvements, leasehold improvements and indirect construction costs, when applicable. Separating these faster depreciating assets into their proper categories allows for the frontloading of the appropriate tax deductions, lowering upfront payments and increasing cash flow. Which means you shouldn’t have to wait all those years to get a tax deduction for them.

The IRS allows multifamily investors to write off each year as an expense through something called “depreciation”. This is only a “phantom” expense, meaning it doesn’t actually cost you anything but it does reduce your taxable income. The reason for this is simple: the U.S. government wants people to invest in real estate; it’s actually a tax incentive, and it’s required by law. To illustrate the magic of depreciation, let’s look at this example.

The main thing to note here is that the $10,000 you put into your pocket is entirely tax free. Instead of showing a taxable income, your tax return shows a taxable loss. Amazing, isn’t it? You can even “carry forward” your “loss” to future years or you can use it to offset gains from other passive income – further reducing (or even eliminating) taxes in the future, too.

WOW! Do your stocks do this for you?

Depreciation is a benefit of ALL real estate investments, but multifamily gives you an additional tax bonus – called “bonus depreciation”. Recently Pass into law, bonus depreciation allows us to deduct the entire value of the investment from our taxable income in the first year. This produces a GIANT tax loss that we can carry forward and apply to other passive income – reducing our even eliminating taxes paid on any gain. And if we sell for a big profit at the end, we can do something called a “1031 Exchange” that allows us to defer taxes – indefinitely. No other investment on the planet offers such incredible tax benefits.

5. Inflation Hedge Multifamily investments are a fantastic hedge against inflation. If you recall, the Federal’s Reserve’s inflation target is 2% each year, which means everything goes up in costs, including rents. And as income goes up, so does the value of the property. I hear you saying “Yes, but no so fast. It’s true that rents are going up by 2% but so are expenses! And that keeps the net income of the property the same and with that the value of the property, isn’t that right?” Actually no … take a look at the following table that shows both the rents and expenses going up 2% each year, look at what happens to the Net Operating Income:

The Net Operating Income (or “NOI” for short) is going up! And the higher the NOI, the higher the value of the property. In fact that small 2% inflation rate results in a 10% average annual return on the cash invested in a typical real estate syndication. It’s like magic: the more inflation goes up, the more the apartment building appreciates – the perfect hedge against inflation!

The best investment no matter where you are overseas – by far – is passively investing in “multifamily syndications”.

Most investors invest their hard-earned money in the stock market. It’s not their fault, really, because that’s what 99% of financial advisors advise their clients to do! But as we’ve seen, the average annual returns of the stock market (after fees, inflation and taxes) are a mere 1.62% over the last 20 years. Coupled with the uncertainty of a market crash makes this investment class questionable at best. After studying every other possible alternative, I’ve come to the definitive conclusion that investing in multifamily syndications is the best investment on the planet. No other investment performed so well in the last recession and offers above average returns (including cashflow), extraordinary (and legal) tax advantages and a built-in hedge against inflation.

If you have any additional questions, please email me directly at James@jcoreinvestments.com

A Trillion What

This has been covered a trillion times (pun intended), however I think people need to be reminded on how much of anything encompasses a trillion. Joe Biden offered up his plan for a 1.9 trillion dollar stimulus package and I am flabbergasted by the sheer number of dollars that our government is able to spout with a straight face. I am not going to dispute that people and small businesses are in great need of this help. This is not to debate of which party spends more, the only goal is to put a face to the behemoth of a 1 followed by twelve zeros.

I’ll make you the richest person in the world ( well kinda)

I am a genie and I am going to grant your wish and pay you 1 dollar every second for your entire life, from the time you are born to the time that you die. If we do some quick math, every day of your life you will make $86,400. With that figure in mind we can calculate your annual one dollar a second income to be 31.5 million dollars every single year of your life. To keep things simple you will also not have to pay taxes, because I am a genie and I can make that happen.

OK, let’s figure out how much you would make in your lifetime

On average a US male lives to be 78.5 years old, but for the sake of argument we are going to round to 80 years. So if you made $1 for every second of your life you would accumulate a grand total of $2,522,880,000. That is 2 billion, 522 million, and some gas money, to spend on whatever you want, all completely tax free. Side note: that wouldn’t even get you in the top 200 billionaires, you would still need another 5 billion just to break into the list.

OK, so you’re not the richest, but does this have to do with a trillion?

You’re right, but I am getting to the point. Let’s say that you wanted to crush the billionaires list and be the first guy with four commas. Screw the three commas club!. At your current rate of income to reach 1 trillion dollars you would need to live for 31,709.79 years.

Wait a minute, that sounds like a really long time…

Glad you brought that up. You would have to start making one dollar a second, 86,400 dollars a day ~20,000 years BEFORE the Saber tooth tiger became extinct and ~28,000 years BEFORE Wooly Mammoth became extinct. By the way, to get to the 1.9 trillion in the aforementioned stimulus package, it would take you ~60,208 years, which would put you into the end of the middle paleolithic era. Maybe you should have wished for $100 a second?

Oh god, what about the national debt?

Why would you even ask that! The national debt is racing toward 28 trillion dollars. With that in mind, using our calculation of $1 a second, the national debt would take approximately 881,000 years to pay off the national debt. However that 881,000 years does not include interest. That would put us closer to the Big Bang.

By Chris Hinshaw

Multifamily is the Best Passive Investment on the planet?

Where else can you get these benefits?

*Below-Average Risk: When the housing bubble popped in 2008, the delinquency rates on Freddie Mac single-family loans soared, hitting 4% in 2010. By contrast, delinquency on multifamily loans peaked at 0.4%. So, if you’re looking for a recession-proof way to invest your money, there is no better option than apartment building investing.

*Above Average Returns: As I describe in the Special Report, the average stock market return over the last 15 years was 7.04% but after fees, inflation, and taxes that return becomes a paltry 2.5%. On the other hand, multifamily syndications routinely return average annual returns of 10% and above. That’s compounded (i.e. without volatility) and after fees, inflation, and yes, even taxes.

*Passive Income: Unlike stocks and bonds, multifamily syndications generate cashflow for its investors from the income generated by the property.

*Extraordinary Tax Benefits: Because of the magic of “bonus depreciation”, your investment income is taxed at a much lower rate than any other investment (in fact, you may actually show a taxable loss that can be used to offset other passive income!).

*Inflation Hedge: As inflation increases, so does the value of the property – the perfect hedge against inflation.

Bottom-line investing in multifamily syndication is the BEST Passive Investments on the planet.